In a world where smartphones rarely leave our hands, it’s easy to feel pressured to answer every ring or notification. Yet not every call is as innocent as it seems. Many scams are carefully crafted to spark urgency or curiosity, hoping you’ll react before thinking it through. Understanding how these schemes work is one of the most effective ways to guard your personal information and avoid unnecessary stress.

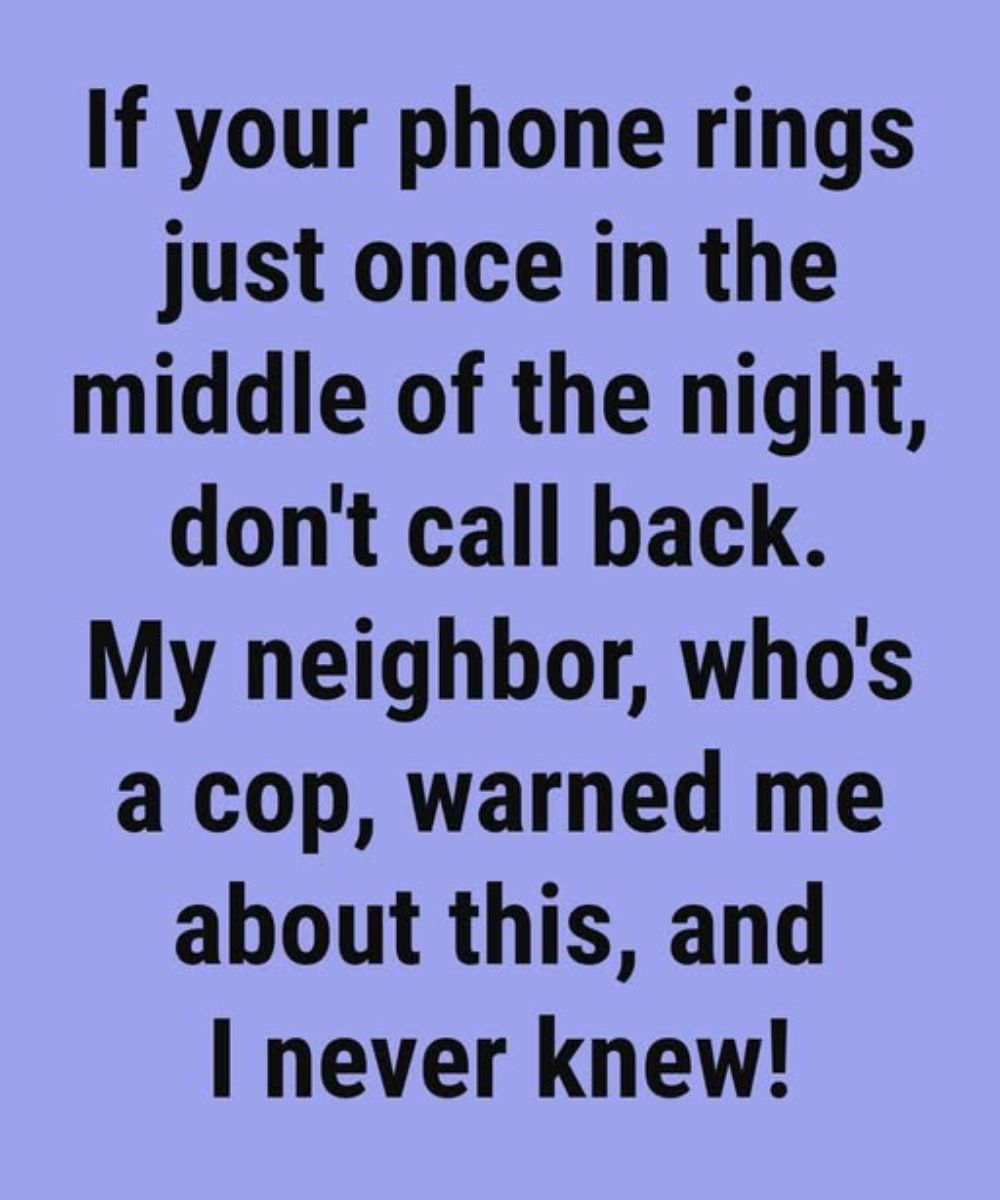

Unknown numbers are a favorite tool for scammers. A missed call might tempt you to dial back, but doing so can sometimes lead to unexpected international charges or confirm that your number is active—making it a target for future attempts. Modern caller ID technology can also be manipulated, allowing fraudsters to mimic trusted organizations or even local numbers. Before returning a call, take a moment to verify the contact through an official website, a legitimate customer-service line, or a trusted directory.

If you do answer a questionable call, don’t panic—just stay proactive afterward. Keep an eye on your financial accounts, activate transaction alerts, and use strong, unique passwords wherever possible. Adding two-factor authentication provides an extra layer of security, making it much harder for anyone to access your accounts without permission. These simple precautions can significantly reduce risk while giving you time to act if something seems off.

Should you notice unfamiliar charges, repeated suspicious calls, or unusual voicemail messages, reach out promptly to your phone carrier or financial institution. They can help block problematic numbers, monitor activity, and prevent further complications. Remember, being cautious isn’t impolite—it’s a smart habit that protects your privacy, your finances, and your overall peace of mind in an increasingly connected world.